Opportunity Mapping helps organizations to create new services or improve existing services based on ideas and concepts generated from customer research. This activity provides the business stakeholders to prioritize the opportunities to create roadmaps.

This article focuses on few ideas to prioritize the opportunities from ideas generated in a brainstorming session. Also, a hypothetical example is shared for this opportunity map activity.

Key Service Design Opportunities

Organizations identify new service opportunities for new or existing services. This article shares the following checklist of uncovering service design opportunities.

- Customer facing improvement

- Process-based improvement

- End-to-End improvement

- Future-facing improvement

- Service Innovation

Activities in Opportunity Mapping

- Create future state ecosystem maps

- Create a 2×2 grid for prioritizing opportunities against impact vs. existing/new services

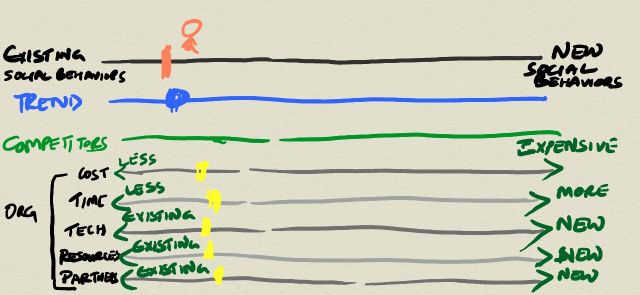

- Map the actors and opportunities on a continuum from no changes to existing social behaviors to new social behaviors

- Map the emerging trends and competitor data below the continuum of social behaviors

- Map the above actors and opportunities against the organization’s capabilities focusing on cost, time, technology, resources, and partners

- Prioritize the opportunities

Example of an Opportunity Mapping activity

Problem

Banks feel that setting up ATMs in rural areas is expensive. How can the banks ensure that their customers can withdraw cash at any point of time without the banks setting up multiple ATMs in rural areas?

Possible service concepts (from Ideation)

- Encourage banking customers to withdraw people from ATM on wheels, which visit at specific intervals in a day (Idea 1)

- Encourage staff at local courier/post offices to send their employees to withdraw money from an ATM in a centralized location (Idea 2)

- Encourage bank customers to send a drone from their current location to an ATM near the branch and the bank’s employee securely sends the cash through the drone (Idea 3)

Activities to prioritize opportunities from a service concept

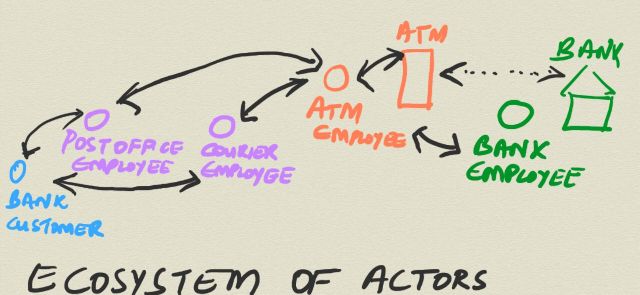

Identify an ecosystem of actors from a prioritized service concept

(Idea 2)

Identify the new and existing actors, their capabilities and the interdependence of the actors

- Identify an actor

- Map which parts of the service concept is relevant to the actor (opportunities)

- Continue step 1 and 2 for all primary and secondary actors

- Prioritize the actors, relevant capabilities (new roles) and opportunities for the service concept

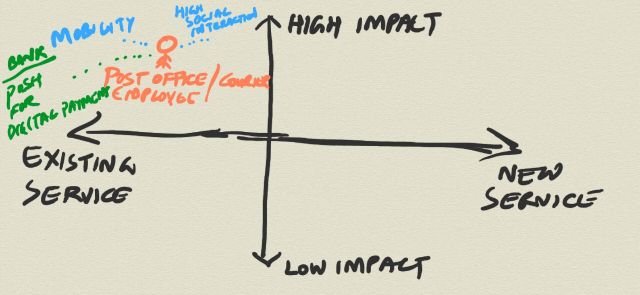

Rank actors and opportunities against impact on customer experience

Rank actors, capabilities, and opportunities for impact vs. new services/existing services in a 2×2 grid

- Prioritize the actors, capabilities, and opportunities for impact (low impact to customer experience vs. high impact to customer experience)

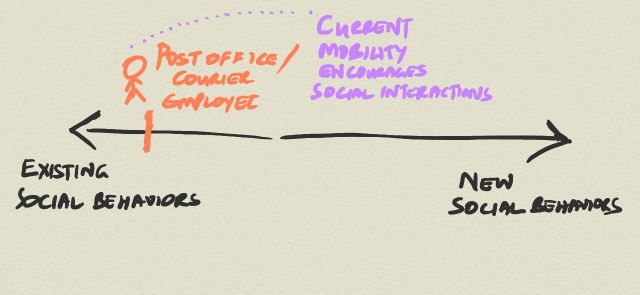

Map actors and opportunities against impact on social behaviors

Map the prioritized actors, capabilities, and opportunities on a continuum of no changes to existing social behaviors to new social behaviors

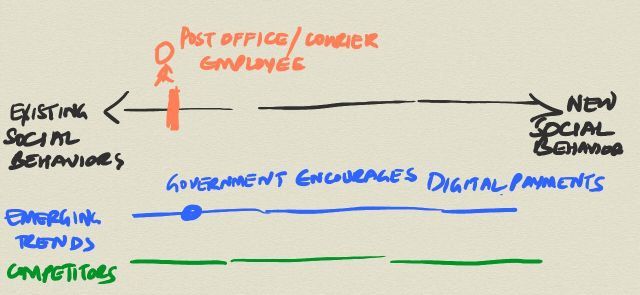

Map trends and competitor data against actors and opportunities

Map the emerging trends and competitor data below the continuum of social behaviors

Map the opportunities against an organization’s capabilities

Map the prioritized actors, capacities, and opportunities against the organization’s capabilities focusing on cost, time, technology, resources, and partners

- Prioritize the opportunities and their actors

- Create service design principles for the prioritized opportunities

- Map a future customer journey focusing on the prioritized opportunities for a specific primary actor

Conclusion

After completing an opportunity mapping activity, the stakeholders would have identified the prioritized opportunities from a service concept. They could continue the same set of activities for other service concepts and decide on creating a roadmap for the prioritized opportunities.